Lînformâtion et les sèrvices publyis pouor IÎle dé Jèrri. I want to claim relief.

Site best viewed at 1024 x 768 resolution in Microsoft Edge Google Chrome 49 Firefox 45 and Safari 6.

. Govje Information and public services for the Island of Jersey. If the goods are removed from one FTZ into another FTZ a Zero-GST Warehouse or Licensed Warehouse GST is not payable to Singapore Customs. Under the Sales Tax Act 2018 sales tax is charged and levied on imported and.

These goods were acquired by me within 60 days of my departure date and paid in full for the amounts indicated in this TRS claim on the associated invoices. Goods and Service GST Act 2014. Making an incorrect declaration Section 1281a of the Customs Act A fine not exceeding S10000 or the equivalent of the customs duty excise duty or GST payable whichever is the greater amount.

GST e-invoiceIRN System Frequently Asked Questions Version 14 Dt. GST Calculator GST shall be levied and charged on the taxable supply of goods and services. Section 271c of the Customs Act A fine not exceeding S5000.

If the goods are removed from the FTZ for export ie. You may be required to repay the GSTWET refunded under the TRS plus any additional customs duties and taxes payable on the ENTIRE VALUE of ALL the general goods you are importing. As per Rule 484 of CGST Rules notified class of registered persons have to prepare invoice by uploading specified particulars of invoice in FORM GST INV-01 on Invoice Registration Portal IRP and obtain an Invoice.

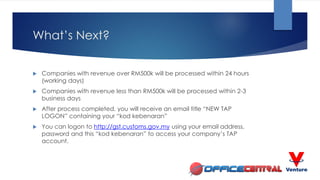

Pay your Goods and Services Tax GST and customs duties. July 1st 2017 was a historic day for the nation as the Government introduced the Goods and Services Tax GST which is one of the biggest tax reforms which the country has witnessed since independenceI am hopeful that this website would be able to cater to the queries raised by the Trade on issues relating to GST law and procedures. More 116 10052019 Compliance Audit Framework.

DOWNLOAD Download form and document related to RMCD. GST Guide On Declaration And Adjustment After 1st September 2018. Transshipment GST is not payable to Singapore Customs.

Royal Customs Malaysia - Jabatan Kastam Diraja Malaysia. If you are a non-GST registered business. Or imprisonment for a term not exceeding 12 months or both.

From 1 Jan 2023 if the total value of your imported services and low-value goods for. More 118 22042019. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

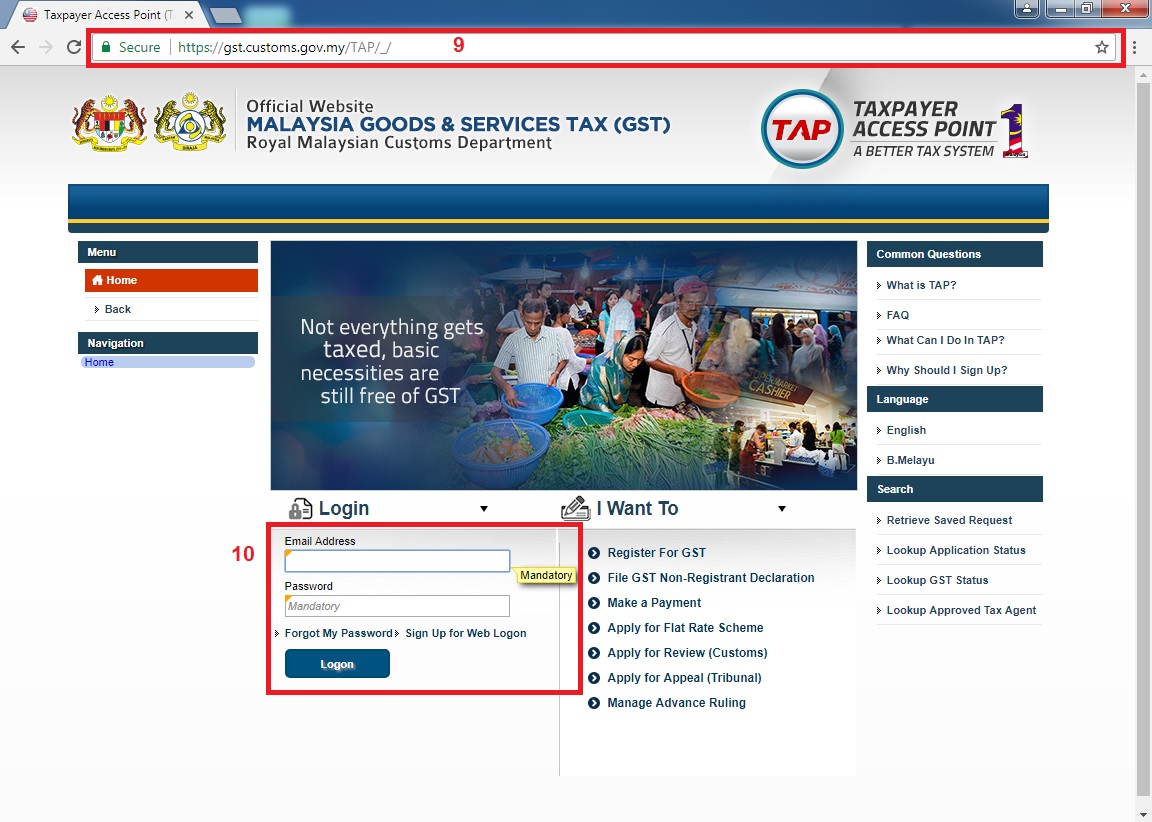

You do not need to report the. Log in using username and password ii Choose exemption menu. Whilst Singapore refers to customs territory.

Goods and Services Tax. AMOUNT RM SUBTOTAL RM. Official website links end with govsg.

To calculate GST value based on the salespurchase value. Government agencies communicate via govsg websites eg. GST is also not chargeable as the supplies are out-of-scope.

Secure websites use HTTPS. Please contact your nearest Customs Office. The CustomsSG web application is a convenient way for travellers to declare and pay duty andor Goods and Services Tax GST on their overseas purchases anytime anywhere before the travellers arrive in Singapore.

More 117 02052019 Borang SST-ADM. CGC Front End standard Edition Version 190for GST 31 March 2015 ASEAN CHINA configuration manual for CGC Front End 17 February 2015 Mutual Recognition Arrangement MRA between JKDM and Japan Custom 1st March 2015. Segala maklumat sedia ada adalah untuk rujukan sahaja.

Central Board of Indirect Taxes and Customs. I want to clear my goods through customs. Log in to MySST portal wwwmysstcustomsgovmy registered manufacturer.

Grievance against PaymentGST PMT-07 Grievance against PaymentGST PMT-07 User Services. Travellers with purchases that have exceeded their personal duty free concession or GST relief can use CustomsSG. More 115 17052019 GST Guide On Tax Invoice Debit Note Credit Note And Retention Payment After 1st September 2018.

Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. Help and Taxpayer Facilities.

2 How To Check Is It Your Company Was Under Sst Smart Acc E Support

Royal Malaysian Customs Department

Bernama Zazuli Is New Customs Director General

Gst System Changes Take Note Of Svdp Poster 01012022 The Portal Is Not Yet Live Https Myva Customs Gov My Index Php Auth Login Facebook

Gst Customs Gov My Log In Arturodsx

Search Results For Apex Global Engineering

Gst Customs Gov My Log In Arturodsx

Tyre Retreading Manufacturers Association Of Malaysia Trmam Mysst Portal Is Now Available Register Today

Malaysia Gst Company Registration Evoucher Registration For Smes

Gst Talk Malaysia Home Facebook